Chart Smarter: Why One EMS Agency Ditched Paper for Mobile Tech

Three Ways for Billing Departments to Handle Financial Hardships

Written by: Maggie Adams (3 min read) Self-pay accounts are an ongoing frustration for billing departments

.jpg?width=864&name=iStock-926235068%20Cropped%20(1).jpg)

Written by: Maggie Adams

(3 min read) Self-pay accounts are an ongoing frustration for billing departments. The best billing system can’t solve the problem of those patients who are unable to pay their bill. Pursuing patients who will never pay wastes time and resources that could be better expended on getting viable claims paid. So, let’s discuss three steps that can be taken to address the problem of financial hardship.

1. Develop a Financial Hardship Policy

This is a policy that many organizations don’t usually consider. There are policies for how to document, how to create claims, and how to send bills and statements. But what happens when the call comes in from the patient who can’t afford to pay? Providers are compassionate people. A balance needs to be struck between compassion and the reality that staff must be paid, supplies must be purchased, and vehicles need fuel. A financial hardship policy is a good way to strike that balance. It would be advisable to note in the policy that the organization will pursue billing and collection from all patients. However, if the patient demonstrates financial hardship, the organization will write-off the balance of the claim.

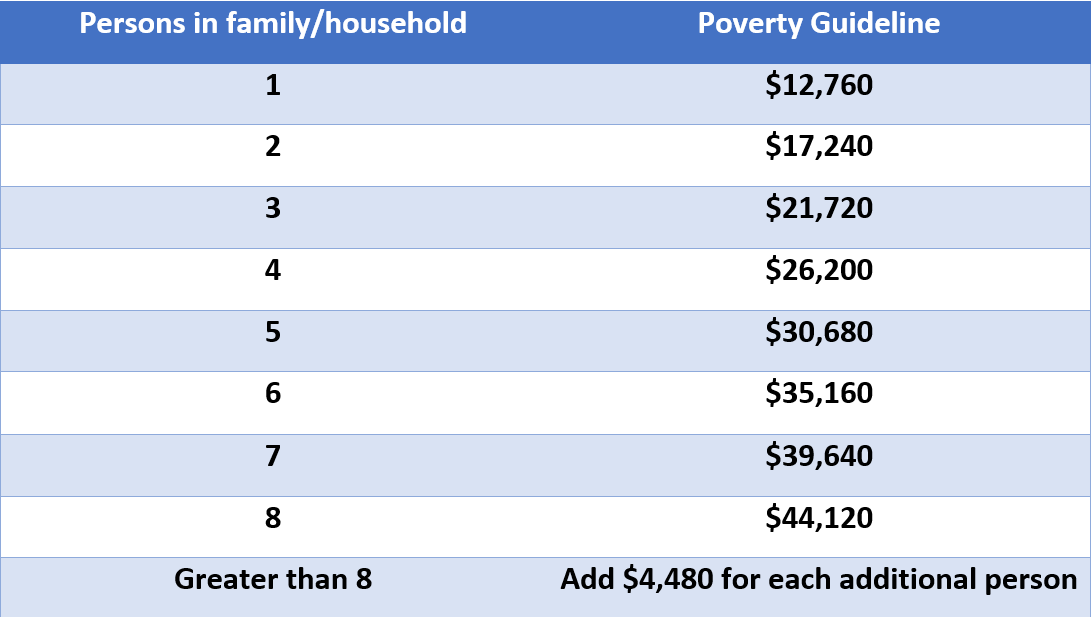

2. Follow the Federal Poverty Guidelines

This step is how you determine if the patient meets financial hardship standards. Poverty Guidelines are published by the Department of Health and Human Services once a year (usually in January). They are simple to follow. Begin by asking how many people are in the household. Note that the caption below is “persons in family/household.” In today’s world of blended families and unrelated people who share households, it is not necessary to determine who is related to whom in the household.

Further, there is no need to collect proof of the patient’s financial status or copies of their mortgage statement, utility bills, or list of medical bills. Poverty Guidelines are based on household size and total income. Create a simple form or letter to be sent to the patient whereby they answer the questions of household size and total income.

Providers have asked, “can’t the patient ‘scam’ us or ‘play’ us?” Yes, that is possible but not probable. If the patient reaches out to the provider to seek forgiveness of their debt due to financial hardship, it is more likely they will respond to your request for information.

2020 POVERTY GUIDELINES – 48 CONTIGUOUS STATES & DISTRICT OF COLUMBIA

SOURCE: aspe.hhs.gov, Published 1/8/20

3. Be Prepared for a Change in Status

Say you are watching the news one evening and see the patient with a big check in their hands because they just won the lottery. Lucky patient! Their financial status has improved. Therefore, when you send the document to the patient where they indicate the size of their household and the annual income, include a commitment paragraph that if financial circumstances change, the patient will pay the bill.

Once the paperwork is received, make a note in the billing system and write-off the account. If things change in the future, the account can be reactivated. In the meantime, your organization will have demonstrated compassion and freed up time to chase other accounts that could pay.

Related Posts

The End of Delayed Documentation

4 Must-have Data Points for Dispatch-Billing Alignment and Maximum Reimbursement

ZOLL Pulse Blog

Subscribe to our blog and receive quality content that makes your job as an EMS & fire, hospital, or AR professional easier.

ZOLL Pulse Blog

Subscribe to our blog and receive quality content that makes your job as an EMS, fire, hospital, or AR professional easier.